MKT701-Analysing The Chase Sapphire Case Study

Jan 31,22MKT701-Analysing The Chase Sapphire Case Study

Question:

Please read and analyze the Chase Sapphire Case Study. Then, working independently, please answer the following questions:

1.Basis your reading and understanding of the case, what were the reasons for targeting Millennials with the Chase Sapphire products

2.Do you think there were any risks to this strategy, according to the details of the case? Should we be concerned about them, given how the different ways the industry does Consumer Segmentation? (Hint: I think we should be.) How big of a risk do you think these risks pose, given how JP Morgan Chase’s Consumer & Community Banking Group earn Revenue? Can you quantify or dimensionalizeit?

3.Reference Chapter 7, Differentiation & Brand Positioning, from Marketing Strategy: A Decision-focused Approachto describe some of the levers that Marketers use to find competitive “white space” and define Brand Positioning. (Hint: focus on p.167- 179; do NOT just list the Steps of the Process.) Be mindful of how they’re thinking about competitive alternatives.

4.How has Chase positioned the Sapphire Brand with their Consumer Target? What is the evidence of this in the case? How did they communicate it to target Consumers and new Cardholders?

Answer:

Introduction

Chase Sapphire Case Study

Student Name:

Student Id:

Module Name:

Table of Contents

Task 1. 3

Task 2. 3

Task 3. 4

Task 4. 5

Reference list 7

Task 1

There were many reasons for targeting the millennial with the products of Chase Sapphire credit card. They are discussed below.

Sign up bonus: The signup bonuses of the credit cards of Chase Sapphire are much higher than that of the cards of other companies. If a millennial spends four thousand US Dollars within the three months of opening the account in the Chase Sapphire Company then the person can get almost 100000 points as a bonus. The person can also spend those points very easily without any restrictions. The annual fees of the credit card of Chase Sapphire Company are very low. It is only ninety-five US Dollars. This is easily affordable by the Millennia’s.

Earning rate: The rate of earning of the credit card of this company is very remarkable. The company announced that the credit card holder of Chase Sapphire Company can earn up to 25000 bonus points until March 2022. This is five times bigger than the peloton purchase. The person can get five times more on various travel purchases. Not only that but the person can get three times more services on various takeout and dining outs. The person can get three times more services on selecting different types of streaming services. Besides, the person can get services on purchasing various grocery products online.

Rate of redemption: However, the rate of redemption can also be found for various airline services and different types of hotel booking services (Morgan, 2018). Chase travel portals provide more points for the users to get as bonus points.

Task 2

Various kinds of risk factors can come forward while dealing with the bank. One of them is the risk of credits. The acceleration of low carbon technologies can put pressure on various expenses of those companies. As the company operates various carbon-intensive sectors, taking credit in order to explore those sectors could lead to a big credit for the clients and consumers. This kind of exploration needs a big amount of investment also for the clients. On the other hand, many operational activities can create more risks for the clients. Various operational changes can be seen and these kinds of operational changes can damage the property of the clients. It can create interruption for the businesses also.

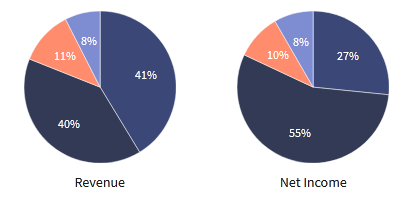

However, the company has many segments that create opportunities for the company to make money. One of the most effective segments for the company to generate more revenue is its consumer and community banking. As the company conducts various kinds of financial services across the whole world, the company is the largest bank in the United States by its assets and properties. Various kinds of investment banking, consumer banking and commercial banking are the main segments for the company that helps the company to generate more profits (Albritton & Holmes, 2020). However, asset management for corporations and various individuals also helps the company to develop its profit margins.

Figure 1: the revenue of Chase’s Consumer & Community Banking

Source: (Albritton & Holmes, 2020)

Task 3

Many levels are available for the marketers to find out the competitive white space for the company. They are discussed below.

Differentiation: The differentiation in the process of marketing is a strategy that helps the companies to differentiate their products or services from other rival companies. The approach mainly refers to the understanding and the ideas of the needs of the clients and consumers. According to the strategy, here, the marketing personnel figure out the unique quality of the products and then convey the message in order to attract the customers.

Brand positioning: Brand positioning mainly refers to the positioning plan of a brand that helps the company to achieve its goal (Fayvishenko, 2018). It helps to create a unique impression for the customers and the clients at the market places. The marketers can use brand positioning with a clear point of view and specific information so that it can create a distinction from the other products of the market.

Targeting audiences: The process of audience targeting mainly refers to the ability to consider the full audience as a group. It helps marketers to create different criteria (Njoki, 2018). It can include various behavioural characteristics, online facilities, demographic changes, recent trends and interests and many more.

However, the marketers can assess various alternatives also in order to expand the market of their products. The marketers can mix their service and the products for the clients. The marketers can fix a new price list for the clients. Not only that but the marketers can develop the brand value for the company also.

Task 4

First of all, the company Chase Sapphire targets their customers and clients in order to develop the brand positioning of its products. To do that, the company assesses their current brand positioning. The company needs to know where it is standing right now and where the company needs to go. Then the company identifies their rival companies and other competitors. It helps the company to know their competitors and it also helps to know the strategies of the competitor companies to target the customers. Not only has that but the company compared the position of their products against the position of the rival products.

However, the company first looks at the customer base of their existing customers so that it would be able to communicate with their existing customers and the existing cardholders. The company tries to get an effective understanding of their costumes so that it would be able to know who they are (Self-service. 2022). Then the company matches their targeted audience to the target market so that it would be easy for them to market the products. Then they list out their main products and services and they list out the best products according to the choice of the customers. The marketers conduct various kinds of surveys in order to know the feedback of the customers about their products. The marketers want to know the point of view of the customers.

Reference list

Albritton, B. R., & Holmes, A. F. (2020). Blue Gilia Construction, Inc.: A Revenue Recognition Case Study. The Accounting Educators’ Journal, 30. Retrieved from: https://aejournal.com/ojs/index.php/aej/article/view/537

Fayvishenko, D. (2018). Formation of brand positioning strategy. Baltic Journal of Economic Studies, 4(2), 245-248. DOI: https://doi.org/10.30525/2256-0742/2018-4-2-245-248

Morgan, J. P. (2018). Fixed-to-Floating Rate Notes due 2024 Issue price: 100.000% $2,250,000,000 Fixed-to-Floating Rate Notes due 2029 Issue price: 100.000%. Retrieved from: https://tbb.moneydj.com/savefile/BondDoc/AA51-1.pdf

Njoki, K. C. (2018). Optimizing Social Media in Corporate Communication Trends Tools and Strategies (Doctoral dissertation, University of Nairobi). Retrieved from: http://hdl.handle.net/11295/105918

Self service. (2022). Chase Customer Service: We can help you! | Chase. Chase.com. Retrieved 18 January 2022, from https://www.chase.com/digital/customer-service.