Financial Decision Making : CVP Analysis

Mar 11,22Financial Decision Making : CVP Analysis

Question:

Discuss about the Financial Decision Making for CVP Analysis.

Answer:

The Financial Decision Making for CVP Analysis

Student Name:

Student Id:

Module Name:

Table of Contents

Introduction. 2

Discussion. 2

Conclusion. 6

References. 7

Introduction

The most important financial decisions can be taken with the help of Cost Profit Analysis. The classification of costs can be converted into variable and fixed portions. This analysis is best for data collection and approximation but it lacks precision and accuracy.

Discussion

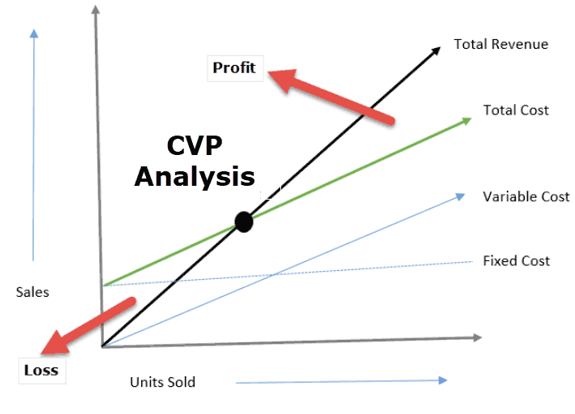

CVP analysis

The output is determined by Cost Profit Analysis that enhances the value related to the particular business. It also puts tress on the influence of fixed costs, target profit and break-even points that determine revenue estimates and sale volume. The CVP analysis makes easier the price structure and price decision simpler. CVP analysis evaluates the price and variations in a company’s cost, both variable and fixed that impact the company’s profitability growth (Islam et al., 2019). The area of accounting and finance utilises this powerful business tool to motivate the managers to adopt consistent decisions for the company’s growth (Achkari & El, 2020). Many accountant professionals and companies make use of the analysis about the service and product they sell. This evaluation focuses on the contribution margin assessment that compares the profit of various products, services or lines on the display. The break-even analysis helps in estimating the sales volume one requires to break down under cost scenarios and divergent prices. This is an inclusive and comprehensive term that also determines how the break-even point is not affected by the rise in the Income-tax rate. CVP analysis offers a systematic procedure for a widened range of decisions. The analysis contrasts the bond between the cost of volume of the goods sold and producing goods.

Figure 1: CVP analysis

Source: (Islam et al., 2019)

The major areas of financial decision making for CVP

All kinds of long and short term decisions use differential costing and this is crucial for choosing the competing alternatives. The areas like production planning, product decision change in activity nature, buying decisions, decisions of sales mix and capital expenditure decision (Mohammadi et al., 2019). The decision making arena using the absorption costing method results in anomalies. The inventories will be curtailed down and contrasts with the -production the sale will be on the rise. Based on the normal or budgeted output, overhead absorption rates are set up and alongside that, the products utilize fixed overheads. The circumstances arise when the managers deliberately influence profit by altering inventory levels. Sales volume has gone up; profit may decline by the principle of absorption costing. The fluctuation of stock levels and distortion of profits will impact the volume of fixed overheads. The qualitative drivers may involve the economical state and its fluctuations, the impact of technological advancements, liquidity risks. Effective decisions can boost future employability and the company’s public reputation. These can also affect employee morale, leadership and enhanced motivation. The factor also determines if the demands are adequate to take in the enhanced production.

Opportunity cost in financial decision making for CVP

Opportunity costs can highlight the area of scarce resources and at the same time the area where resources are plentiful. It is mandatory to accommodate the lost profit where the action needs the implementation of scarce resources. The cash flow coming out of the course of action must be involved in decision making and the flow is considered as the relevant cost. The cost control uses the conventional variance that will illustrate the sales variance and usage variance. Incompetent utilization of scarce resources fails in attaining the optimum level of consequence. The opportunity cost will comprise of lost interest coming out of delay in getting the cash flow and not the contribution (Awan et al., 2020). The managers are responsible to control the use of scarce resources and the charge of foregone contribution is attributed to them. Opportunity cost is the benefit measured when different alternatives are involved. Investment in banks leads to the internet being raised by the opportunity cost of the fund that is invested in the business. It is not crucial that all cost variables have relevance and all fixed costs have relevance. Relevant costs prioritise the cost elements most important for the decisions. Therefore, the element of opportunity cost has a major role in decision making.

Discretionary Cost

These kinds of costs are created by the periodic decisions in terms of the incurred maximum outlay. The relationship between the outputs and the inputs can be seriously affected by this kind of cause and no clear cause is associated with it. The managers spend the costs on executive training, public relations, advertising, research and consulting services. A meeting can be held between the employees and the company to discuss how discretion costs are controlled and they must be conscious of how the variable cost and fixed costs are maintained. The establishment of data must be set up by setting the appropriate goals that will develop the process to control the discretionary cost.

Application of cost techniques in making decisions

The incremental cost process is a prerequisite to influence the managerial decisions that contrast the incremental revenue with incremental costs (Awan et al., 2020). The installation of the new products and shutting down certain segments of the business, suspending requires the decision making of the managers. They decide the continuity of the product and decisions of equipment replacement and submitting tenders are the financial decisions. The other ones include optimising business plans resulting from multiple alternatives. The opening of branches and new sales positioning in the decision, the order from the additional consumers can be accepted at a price lower than the previous one. The decision prioritises the proposal as long as the incremental revenue is greater than the incremental cost. Ad-hoc information is prepared where the income and cost differences between alternative actions are considered.

Buy/Make decisions

The decision to purchase the products from outside sources must not result in the workers getting laid off and the industrial problems creating issues (Yang et al., 2020). The decisions of the product manufactured must not inversely affect the relationship of suppliers and the concerns. The absence of important technical competence leads to the purchasing of the business instruments from outside,

Conclusion

It must be ensured that the risk is always mitigated or controlled by the perfect financial decision making. The management must be qualified enough to utilise the analytical tool CSP properly to ensure excellent service, reasonable certainty to meet up the delivery dates of the products.

References

Achkari, O., & El Fadar, A. (2020). Latest developments on TES and CSP technologies–Energy and environmental issues, applications and research trends. Applied Thermal Engineering, 167, 114806. Retrieved from: https://www.sciencedirect.com/science/article/am/pii/S0960148119303544

Awan, A. B., Khan, M. N., Zubair, M., & Bellos, E. (2020). Commercial parabolic trough CSP plants: Research trends and technological advancements. Solar Energy, 211, 1422-1458. Retrieved from: https://www.researchgate.net/profile/Mohammad-Nadeem-Khan/publication/346173124_Commercial_parabo

Islam, M. T., Huda, N., Abdullah, A. B., & Saidur, R. (2018). A comprehensive review of state-of-the-art concentrating solar power (CSP) technologies: Current status and research trends. Renewable and Sustainable Energy Reviews, 91, 987-1018. Retrieved form: https://kch.fp.tul.cz/sedlbauer/clanek19.pdf

Mohammadi, K., Saghafifar, M., Ellingwood, K., & Powell, K. (2019). Hybrid concentrated solar power (CSP)-desalination systems: A review. Desalination, 468, 114083. Retrieved from: https://www.researchgate.net/profile/Basim-Belgasim-2/publication/324092231_The_potential_of_concentrating_solar_power_CSP_f

Yang, Z., Hu, B., Han, A., Huang, S., & Ju, Q. (2020, November). Csp: Code-switching pre-training for neural machine translation. In Proceedings of the 2020 Conference on Empirical Methods in Natural Language Processing (EMNLP) (pp. 2624-2636). Retrieved from: https://dl.acm.org/doi/fullHtml/10.1145/3402029?casa_token=6XvbivsKbfkAAAAA:TEgdvsq6yW9_xax8qEDjHMmvtrjnd85ILxhgaT1H2pf