Financial And Non Financial Information Of Apple

Mar 11,22Financial And Non Financial Information Of Apple

Question:

Discuss about a Report for Financial and non Financial Information of Apple?

Answer:

Financial and non Financial Information of Apple

Introduction

The evaluation of financial performance is critical for assisting in the early detection of major difficulties and identifying both good and negative trends in business activity. The development of the company’s operations may be highlighted by conducting various assessments, and thus the founders, workers, and consultants can gain access to important data that can be used to plan for the company’s future growth. Apple Inc, a publicly-traded business, is chosen to do the analysis. In the year 1976, Steve Wozniak and Steve Jobs founded Apple. Apple’s prosperity is built on the principle of continuous innovation and marketing through a comprehensive marketing strategy. In addition, The analysis of Apple’s key elements of accounting and profitability ratios have been performed to understand the audits of financial performances and therefore know the firm’s implications as part of the serious evaluation of Apple’s financial report. Apple’s monetary performance is the most important indicator of the economy’s recuperation from the credit collapse of the previous year (Gleiss, Kohlhagen & Pousttchi 2021). The investment repercussions in the production of items that match market demands could be said to be an over median return in income followed by profitability.

Section 1

Sources of Long-term financing

Equity Capital

It refers to the firm’s equity cash, which is stable and comes from publicly or privately sourced. A shareholder with a significant share has some control over the commercial wherein the transaction was made. Either the firm can pay capital from the business through an IPO or it can choose to have a private investor take a significant stake in the company. Inequity financing, ownership is diluted, and the majority ownership is held by the largest stockholder. Furthermore, existing shareholders do not have a preferred right to the firm’s dividends and are exposed to significant risk in every area (Gleiss, Kohlhagen & Pousttchi 2021). Equity shareholders desire a greater return than bondholders due to the larger risk they assume whenever it refers to recovering the cash they have committed.

Preference Capital

The funds raised by distributing preferred stock are known as preferred share capital. When it comes to accessing a set rate dividend and earning their money back if the company goes bankrupt, preferred stockholders have a benefit over equity holders (Sklyar et al 2019). Besides, It is included in the firm’s total wealth, strengthening trustworthiness and providing leverage while dealing with rivals.

Debentures

It is a debt obtained from the general populace via the issuance of debenture certificates bearing the company’s common seal. In sum, Debentures are only covered by the lender’s integrity and image. Debentures are regularly offered by enterprises and authorities to generate money or resources. Debentures can be sold in either a public or a private offering. Fuhrer, if a business decides to improve funds from a wider populace into an NCD, it uses the debtor IPO idea, in which all customers obtain certifications by becoming money lenders.

Retained Earnings

These would be the profits reserved by a company over a certain period to meet the firm’s future financing needs. These are the company’s free reserves, that have no price and are maintained without even being returned. It might be used to continue to expand the business without adding to the debt load or dilution of additional stock in the company outside of shareholders. These are included in total wealth and also have a direct effect on the value of equity shares. Apple had collected $6.5 billion through the credit exchange.

Working capital Theory

Apple’s cash flow has been consistent since last year. Current assets are valued at 28.71 billion US dollars at the moment. The share capital, on the other side, is expected to reach $859.3 billion, while the values, in addition, are expected to fall to 321.9 million.

Current ratio

The financial ratios are generally used to determine short-term profitability about resources able to meet current debts. Apple’s quick ratio is 1.27, indicating that the business has enough cash to cover its financial liabilities. For every $1 in current obligations, it has far more than $1 in current assets.

Current ratio = Current asset/ Current liabilities

Liquid ratio

This proportion is the most appropriate predictor of liquidity. The estimate removes inventory, which can take some time to a stream of cash flows unless cost is reduced, and it focuses only on real & liquid funds. It also helps in answering the question of whether the firm will be able to satisfy its commitments with its quick assets if it does not generate money for an amount of time.

Liquid Ratio = Current Assets-Inventory/Current Liabilities

Inventory days – The days in stock efficiency ratio calculates the median number of days a business maintains associated with making and retailing it. This rate reflects the amount of inventory that has been held in stock.

Inventory days = 365 / Inventory turnover. 2. Stock turnover equals the cost of goods sold divided by inventory. 3. Stock days are calculated by multiplying the average inventory by 365.

The firm’s stock turnover is 55.84 times. Goods days are 365/55.84 = 7, indicating that the corporation sells and restocks stock every 2 months.

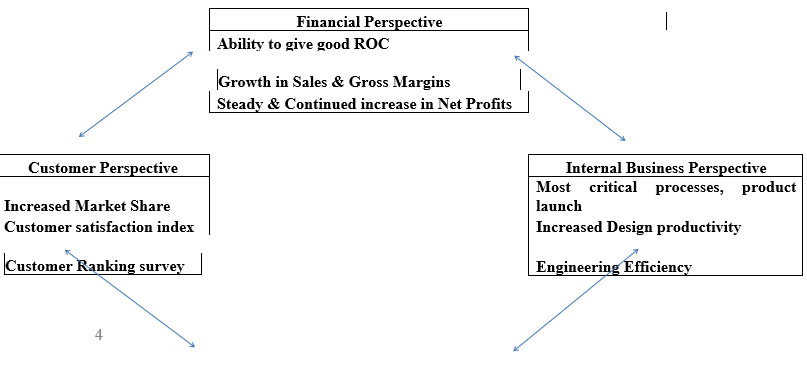

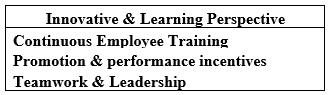

Balanced Scorecard:

The Performance Measurement establishes performance requirements and assesses when the administration is accomplishing its objectives.

Apple’s goal and mission and vision is as continues to follows:

- Apple is dedicated to upholding the greatest social responsibility standards in everything else we do. Whenever Apple products are produced, the businesses with whom we do business must offer workplace safety, help employees feel, and use ecologically sound production practices (Mor & Gupta 2021).

- Produce high-quality, moderate, incredibly simple items for people that use advanced technology. They are demonstrating that high-tech doesn’t have to be daunting for those who aren’t technology specialists.

The following indications help to accomplish the essential success considerations:

Conclusion

The business has been continuously making investments, human capital, and distribution networks to expand into new areas and increase market share for its many goods and services. The management says in producing creative and unique goods, it must continue to invest in R&D and technologies in terms of developing distinct products and gaining a competitive advantage over its competitors. As a result, the business will not only be capable of maintaining its share in the market, but will also be capable of improving its share of the market, total income, and development.

References

Gleiss, A., Kohlhagen, M. and Pousttchi, K. (2021) An apple a day–how the platform economy impacts value creation in the healthcare market. Electronic Markets 1-28

Mor, S. and Gupta, G., 2021. Artificial intelligence and technical efficiency: The case of Indian commercial banks. Strategic Change30(3), 235-245.

Sklyar, A., Kowalkowski, C., Tronvoll, B. and Sörhammar, D. (2019) Organizing for digital servitization: a service ecosystem perspective, Journal of Business Research [online] 104(11), pp. 450-460